This means that the profit on this trade was not about $50 (which was my profit target). The following screenshot shows the entry and the exit price:Īs you hopefully can see, I put on the trade for a credit of $0.81 and closed it for a debit of $0.46. Instead of being patient and waiting for the iron condor to reach my profit target, I actually took it off before that. But that’s actually not how I closed this trade. You might think that this likely wasn’t very special as my GTC order simply got filled.

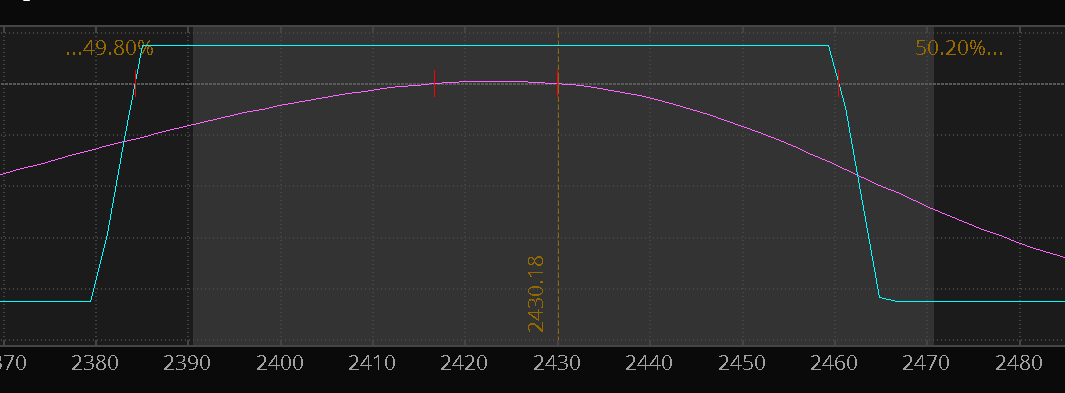

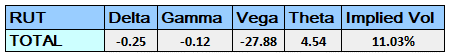

Now I want to walk you through my thought process when taking off this position which was 24 days after I put it on. This means that during the choppy price action, my iron condor profited nicely from the time decay and the decreasing implied volatility. It simply consolidated and chopped around a little (which can be expected after its prior bearish price action). As you can see, EWZ’s price got nowhere even close to the breakeven-points during the lifetime of this trade. The two black lines at 27.38 and 36.71 are the approximate breakeven-points. The entry and exit are marked with circles. Here is an image of how the trade looked like in terms of EWZ’s price development: That is why I put on a GTC (Good-Til-Cancel) order at my profit target right after the iron condor was filled. My goal was to close this position at 50-60% of max profit which would be $40-$50. In my opinion, that is a very good position, especially considering the size of this account. In case it is hard to recognize on the above screenshot, here is a list of all the important metrics:Īs you can see, the final iron condor was very delta-neutral, had a good probability of profit, an even better probability of reaching 50% of max profit and generated over $1 in time decay every day. This is how my position looked when I submitted the order: I felt that choosing these options gave me the best risk/reward ratio and the best probability of profit… After comparing a few different strike prices, I chose the following options: But my slightly bullish hunch did barely impact my strike selection. My directional assumption was neutral to slightly bullish. The October 19 expiration date had 49 days left until expiration, so that is why I chose that expiration date.Īs for the strike prices, I wanted to create a neutral iron condor (so with a delta near 0). For short iron condors, I usually go for 40-50 days until expiration.

I had to choose an expiration date, the strike price for the four legs, an order price, and a trade plan.

#Iron condor example how to

Live trade examples are one of the best ways to learn how to trade.

0 kommentar(er)

0 kommentar(er)